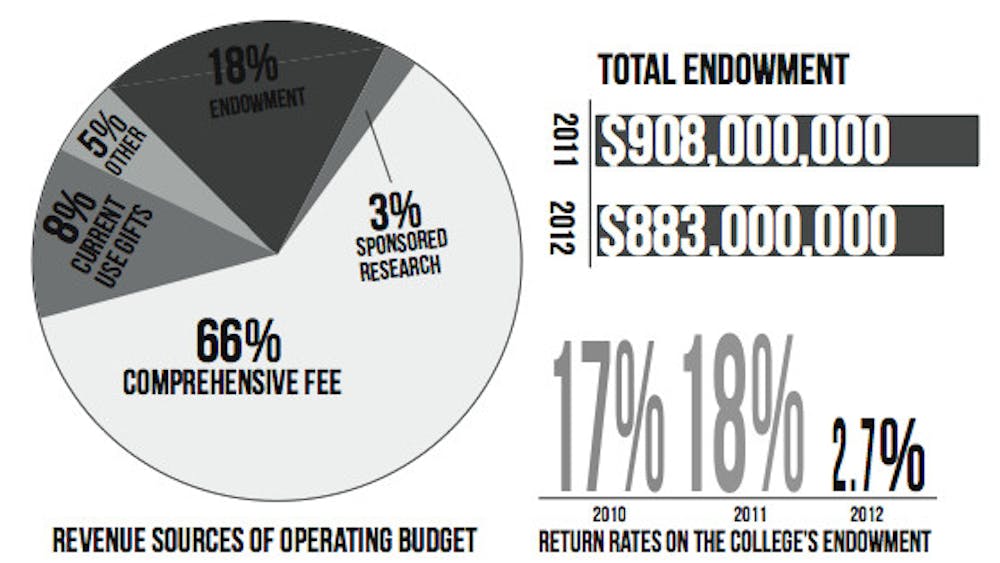

The College is seeking to diversify its traditional revenue sources in the wake of a drop in the endowment growth rate during the 2012 fiscal year. The return on the College’s endowment for fiscal year 2012 was only 2.7 percent, falling short of the five percent target rate and dramatically lower than the 17 percent return in 2010 and 18 percent in 2011. The endowment, the size of which is determined by its growth, spending and amount of gifts, finances 18 percent of the College’s operating budget.

The College spent approximately 5.6 percent of the endowment in fiscal year 2012, as the College continues to pay off the debt and the incremental operating cost of infrastructure projects implemented over a decade ago, such as Ross Commons, Atwater Dining Hall and other facilities on campus.

“Between 1990 and 2004, the College took somewhat of a risk by investing just shy of $300 million in our campus infrastructure,” said President of the College Ronald D. Liebowitz in an interview. “It was a ‘Field of Dreams’ kind of thing — if you build it, they will come. But our facilities needed modernization in order to attract the best students and faculty.”

Liebowitz defended these projects despite the incurred overhead costs.

“The flip side is that we borrowed $200 million to finance the upgrade (and reserves that we fund annually for infrastructure to cover the rest), and we need to pay off that debt for a number of years,” said Liebowitz.

“Some people say, ‘What a risky move that was!’ But the bigger picture is that the College achieved its goals of attracting great students and faculty and providing excellent facilities in which to teach and learn. And, applications increased from less than 3,800 to 8,900 between 1995 and 2011 and we have among the best facilities of all liberal arts colleges,” added Liebowitz.

The below-expected performance of the endowment, combined with these costs, amounted to a change in value of approximately $25 million for fiscal year 2012, a decrease from $908 million in 2011 to $883 million in 2012.

The College’s endowment is managed by Investure LLC, an investment management firm that also invests the endowments of other private liberal arts colleges such as Dickinson College, Smith College and Trinity College. Investure — which is responsible for managing a combined portfolio of $9.1 billion pooled from 13 institutions — does not release to the public specific information about where it invests its money, making it difficult to determine which investments may have yielded the lower-than-expected return.

Vice President for Finance and Treasurer’s Office Patrick Norton pointed to the larger economic situation as an explanation for the change in return value.

“[It was a] tough year for the global markets,” wrote Norton in an email. “We have a $280 million allocation to global equities and while we beat the benchmark (MSCI All Country World Index was -6.0 percent) [this allocation] returned -1.6 percent for the year.”

Despite the change in the endowment’s value, Liebowitz maintains that the below-expected return will not have quite as dramatic of an impact as one might anticipate because the College uses a three-year moving average to determine allocations from the endowment.

“The 2.7 percent return this past fiscal year is not a huge hit to our budget,” said Liebowitz. “The prior two years exceeded the expected five percent return significantly, and so we are in good shape. But if below-five percent returns continue, we will feel it and will need to do some unplanned budget tightening.”

In addition to the endowment and the comprehensive fee, the College’s budget is also funded in part by donations to the College. In fiscal year 2012, the College received $9.65 million in unrestricted gifts, which, unlike restricted gifts and gifts to the endowment, can be channeled, in full, directly to the College’s operating budget.

“Donors have continued to be generous, although we have seen a reduction in long term pledges due to economic uncertainty and desire to re-assess commitments annually,” explained Associate Vice President for Alumni Relations and Annual Giving Meg Groves in an email. “During the downturn we began to emphasize the impact of total giving (current year use and longer term endowment-type gifts) more and also allowed and encouraged our donors to direct their gifts where they thought [they] could do the most good.”

Despite the pressure on the endowment, Liebowitz remains adamant that this cost will not be transferred to the students through a disproportionately large increase in the price of tuition.

Two years ago, the College implemented a “CPI + 1” ceiling on tuition hikes, which limits the annual increase in the comprehensive fee to one percentage point above the inflation rate.

The “CPI +1” ceiling illustrates a response in the College’s financial model to the recent economic downturn and to the growing national debate over the affordability of higher education.

From 1980 through 2010, the College increased the comprehensive fee by an average of 6.2 percent per year, a growth rate consistent with peer institutions’ increases. While tuition currently accounts for approximately 66 percent of the College’s revenue, Liebowitz argued that increasing the comprehensive fee is no longer the answer to financing the College’s operating budget.

“It would be easy to believe, with nearly 9,000 applicants to the College this past year, the demand for a Middlebury education is strong, highly ineleastic, and insulates the College … ” wrote Liebowitz in a memo to the faculty over the summer. “It would be foolish, however, to ignore these criticisms and the wide range of student choices within higher education; both suggest a far greater elasticity of demand.”

The decision to tie tuition to the CPI has come under criticism, but Liebowitz defends the policy.

“There were many, including a number of my faculty colleagues, who pointed out that CPI+1 ‘leaves money on the table’ — that if we can charge more, we should,” said Liebowitz in an interview. “But we need to take the long view. We need to think about our families and students and those who will turn away from even applying to Middlebury if the costs keep increasing as much as they have.”

The CPI + 1 ceiling on the comprehensive fee and the recent decline in the endowment growth rate have renewed the importance of pursuing other sources of income to finance the College’s operations.

“The Language Schools, the Bread Loaf programs, the Schools Abroad and Monterey diversify our sources of revenue beyond the undergraduate college’s traditional revenue generators,” wrote Liebowitz in the memo. “[This leaves] us less dependent on any one source of income, and less vulnerable to economic volatility than would otherwise be the case.”

The income from the College’s outside operations, all of which registered operating surpluses for the 2012 fiscal year, has helped the College stay competitive with peer institutions that benefit from much larger endowments.

Recently, the College undertook a for-profit venture in response to the need to subsidize the cost of providing an ever more expensive education. Middlebury Interactive Languages (MIL) is the College’s for-profit online language education venture, and is expected to become profitable in fiscal year 2013 after a three-year start up period.

While Liebowitz expressed confidence in the College’s financial health, he also warned in his memo that the current model of higher education may not be a sustainable one.

“It behooves us to think collectively and creatively about how best to preserve what it is we do and value most, while understanding too, the need to think about the future and the consequences — both intended and unintended — of whatever choices we make in amending what has become an unsustainable cost structure.”

Endowment Hit by Low Returns

Comments