Following Sunday evening's discussion on divestment by Schumann Distinguished Scholar Bill McKibben, the Campus Current is back with another liveblog from McCullough Social Space, starting at 7:30 p.m. Tonight will feature a "wide-ranging panel [discussing] the ongoing debate over whether environmental and social concerns should influence investment policies of college and university endowments." The panel will include Charlie Arnowitz ’13, Ralph Earle, Alice Handy, Mark Kritzman, Vice President for Finance Patrick Norton, and McKibben. The event will be moderated by David Salem '78. Additional information on the panelists is available on a website devoted to the discussion.

According to the press release, "It will focus on two questions: what factors should the college’s board of trustees consider in determining whether to place restrictions on how Middlebury’s endowment is invested, and what are the advantages and disadvantages of using divestment as a means of addressing climate-related concerns?"

The Campus Current will provide a liveblog below, but a live stream is also available online. Additionally, the Campus will be providing detailed analysis of the panel in Thursday's issue.

With Additional Reporting and Photography by KATHRYN DESUTTER and CHARLOTTE GARDINER

-----

9:33 - Salem thanks the audience, and smooth jazz begins playing as the audience continue the discussion amongst one another. Signing off from the McCullough Social Space. Thanks for reading!

9:32 - Salem concludes the panel, reminding the audience that he has done his best to maintain neutrality. Salem admits that he has heard things that “don’t ring true to me.” He encourages audience members to use the website to continue to investigate the facts.

9:30 - As McKibben speaks, there is snapping in agreement from the audience. Salem gives Earle the final word, who confirms McKibben’s assertion the investment field “is an exercise in masochism.” He continues, “The missing piece — not just in the US, but globally — is government [action] against climate change.” McKibben then jumps in and confirms the need for action at the governmental level.

9:28 - McKibben continues, “There is no $420 million cost at stake here. We’ve found out tonight that less than 1% of our endowment is invested in the top 200 companies we’re targeting here.” Handy interrupts and asks McKibben to remember that due to the commingled investment, more than just Middlebury’s 1%, or $9 million dollars, is at stake. After a brief interjection from Kritzman to support Handy’s argument, McKibben again takes the mic to quote the “Middlebury Divestment Reader” that was distributed by student volunteers at the start of the forum, and available for download below.

9:24 - A student asks what solutions would be more effective than divestment, and if it’s feasible for Middlebury to spend the amount currently invested in fossil fuels and arms manufacturers “directly on its values.” Kritzman fields the question: “I apologize for trying to interject some of the science and rationality into the conversation.” He continues by elaborating based on the historical example of tobacco.

9:20 - This is followed by a request for Handy and McKibben to address the differentiation between divesting from fossil fuel companies and arms manufacturers. McKibben begins by thanking Liebowitz for providing numbers on the College’s endowment and highlighting that less than 1% of our endowment is invested in arms manufacturers, and in combination with investment in fossil fuels, the amount in question remains less than 5%. Handy emphasizes that investment is in commingled managers, which presents broader implications of the issue before McKibben injects that there are other places to find $900 million. "That's the beautiful thing about Capitalism."

9:17 - Another student then asks Norton about the potential effect of divestment on need-blind admissions. Norton echoes Kritzman’s findings that the loss that would come as a result of SRI would have a “devastating” impact on the College from a long-term perspective.

9:15 - Teddy Smith '15 askes Handy if she would be willing to work with students to better understand the endowment. Handy’s reply is short: “Absolutely.”

9:14 - "That was about three and a half minutes," Salem says before moving onto the next question.

9:13 - Jay Saper ’13 asks the panelists and the audience to recognize that those most affected by climate change and violence are not present. Saper walks along the first row of chairs, naming parties and individuals not present — ranging from the Palestinian people to a student from Sandy Hook elementary — and highlights their absence at the forum. "There is a cost to death. The cost is unimaginable."

9:11 - Fernando Sandoval Jimenez '15 asks how many clients need to support a move to SRI in order to enact the policy completely? Handy responds by saying it would take an agreement by all clients.

9:07 - Earle responds first and confirms Kagan’s assertion of the risk of opportunity cost. According to Earle, if divestment turns out to be an ineffective strategy, then there is an enormous opportunity cost of the money and energy expended on divestment campaigns. McKibben follows Earle, stating: "It's by no means a silver bullet, it's one thing we need to do!" McKibben, citing Professor of Economics Jon Isham’s research, laments the lack of a price on carbon to motivate investors.

9:00 - Max Kagan ’14 directs a question toward McKibben and Earle, asking about potential downsides to divestment, primarily within the framework of opportunity costs and the historical record of divestment in the tobacco industry, Sudan and South Africa. He released an op-ed in the Campus with similar points in November.

8:59 - Salem then solicits questions from the audience and requests that the questions be limited to approximately one minute. He also encourages audience members to consult online College materials for answers, and also to share remaining questions on the forum’s website.

8:57 - Kritzman then presses McKibben for the “scientific outcomes” of divestment. McKibben again uses the historical anecdote of South Africa to draw a parallel.

8:54 - Salem quiets the audience before moving the panel onto questions, which will be posed among one another before being posed by the audience. For the first question, Arnowitz presses Handy to elaborate on the aforementioned “creative solutions” that Investure could employ in a divestment strategy. When Handy answers in somewhat vague terms about Investure’s model, Arnowitz presses for specific solutions. Handy’s response: “I don’t have an answer for that.”

8:52 -"It's hard to imagine how we could live with ourselves otherwise," he concludes. McKibben receives a standing ovation by approximately one-third of the audience. A letter from Steyer is distributed to members of the audience.

8:51 - McKibben, in citing personal friend Tom Steyer, manager of a hedge fund of over $20 billion, argues that “this [divestment] can be done, is a good investment strategy, and that divestment is a way to make yourselves heard."

8:47 - McKibben emphasizes that “endowment return is not the only financial indicator to worry about” when considering the funding source of the College. McKibben cites donations as one of several other sources of revenue. He continues in discussing his pride in the College’s pledge to carbon neutrality, but argues that “it makes no sense to green the campus without also greening the portfolio.”

8:44 - "My car gets more than 50 mpg, and the Arctic melted last summer.”

8:42 - “Our hope is not that we can bankrupt Exxon … but we do believe that history shows that divestment can change the course!” McKibben cites the liberation of South Africa, which fell victim to a strong divestment movement in the 1980s, and eventually repealed apartheid.

8:41 - McKibben reiterates many of his points from Sunday evening: “These industries are different — the flaw is the business plan.” A few students snap throughout the many of McKibben's remarks.

8:40 - McKibben proposes that the College pledge, in the course of the spring semester, not to invest new money in fossil fuel companies, and over the next five years, taper the investment to zero. He proposes that the same policy be adopted for arms manufacturers. McKibben acknowledges Norton’s reference to “inter-generational equity” and explains his view that it is “morally wrong” to invest in companies whose missions “ensure that students will not have a planet” to inherit.

8:37 - McKibben begins by explaining that he is nervous. When he remarks about his own “low net worth,” several members of the audience chuckle and snap. McKibben then thanks Arnowitz, to more applause, before requesting that the audience not applaud or interrupt so he can remain within his time limit.

8:35 - Salem now introduces McKibben, the sixth and final panelist. He challenges McKibben to propose a process that the board of trustees could employ if the board chose to embrace divestment.

8:34 - Earle concludes by urging critical thinking. “This is a multi-generational problem that will not be solved overnight,” says Earle.

8:33 - Earle then proposes steps that colleges and universities might take: 1) Encourage proxy voting that would require environmental expertise on the board of energy companies. Earle warns, “you [currently] can’t vote if you’re not a shareholder.” 2) Encourage collaborative research and use of resources to develop sustainable technologies. 3) “What can students do?” He suggests a pledge to never buy a vehicle that consumes less than 50 mpg. He then suggests that students shift their own consumption from coal to renewables. “Find out how your utility generates electricity. If it’s from coal — fire them!”

8:30 - 'It’s my view that the entire fossil fuel industry is too large a target, and I advocate a more specific strategy directed primarily at the greatest [firms] that impact climate change, namely coal.'

8:29 - Earle advocates for the use of funds toward purchasing “vast supplies of inexpensive natural gas,” which has half the warming potential of coal.

8:27 - Earle announces that he is “in complete agreement with 350.org’s goals.” However, he immediately clarifies that “I don’t think that divestiture from fossil fuel stocks will be effective in reducing climate change.” Earle cities divestment from the tobacco industry and the Sudan as not having a large impact. He further argues that the world's largest fossil fuel companies aren’t publically traded.

8:25 - Salem then introduces Ralph Earle, asking for his reactions to what he has heard thus far; in particular, he highlighting Arnowitz’s opinions of the importance of student input.

8:23 - Kritzman closes with the advice that “well-intentioned investors should measure these two approaches and decide which they believe to be most effective."

8:21 - Kritzman then shows a slide that assumes a $1 billion portfolio invested in the S&P 500, EAFE, the Developed World and the entire world over a period of 5, 10 and 20 years. A table of these factors demonstrates the cost of socially responsible investing, culminating in a $420 million loss if the $1 billion was invested worldwide over 20 years.

8:18 - "I hope you're following. I know it's hard to concentrate when it's so exciting."

8:15 - "An inarguable mathematical truth that socially responsible investment is costly." Kritzman follows his statement that “it’s pretty simple to estimate the costs,” and introduces a (very) text-heavy slide which utilizes a “Monte Carlo simulation."

8:14 - Kritzman explains the channels through which socially responsible investing has an economic impact. Socially responsible investing can raise a bad company’s cost of capital, draw attention to a "bad" company’s "bad" behavior, and in drawing attention to this company, may persuade it to reform.

8:11 - “At the outset, let me just say that I do not have a view as to whether you should restrict your investment universe or not, but I have a view that you should at least understand the consequences of these two choices when you make that decision."

8:10 - Salem then introduces Mark Kritzman, who loads a visual PowerPoint presentation to accompany his response. Kritzman explains that he will outline the cost of socially responsible investing.

8:09 - Arnowitz urges students to remember that "every student's voice is legitimate" and "not [to] demonize other community members." Rather, student must focus on "the most effective way to steer this debate." Arnowitz concludes to an enthusiastic applause.

8:07 - Arnowitz cites the SGA student survey, which has surveyed almost 50% of the student body. According to collected data, 40% of respondents thought divestment was a “very or extremely important issue.” Arnowitz cites several other stats that demonstrate student commitment to the issue of divestment. Here is the full breakdown of numbers provided by Arnowitz following the panel:

Based on the SGA’s recent survey, which as of 3:00 this afternoon had 1,031 respondents, around 45% of the student body: 63% of respondents think the College should apply the principles of socially responsible investing to its endowment. 14% are opposed and 23% have no opinion. In terms of prioritizing SRI, 28% think it’s not particularly important, 32% think it’s somewhat important, 40% think it’s very or extremely important. In terms of divestment, students favor a diversity of approaches. 38% support divestment from arms and the top 200 fossil fuel manufacturers. 10% prioritize fossil fuels. 12% prioritize arms manufacturers. So total of 60% support some kind of divestment, 15% don’t support divestment, 25% have no opinion.

8:05 - Salem introduces Arnowitz. He thanks the organizers for including a student on the panel and acknowledges that many parties affected by these decisions are not present at the forum, to which a few audience members snap in agreement. Arnowitz continues, “We insist that student views be at the table and that students’ views be taken into account.”

8:03 - Handy discusses constraints, such as the required 8 percent return (5 percent to cover spending and 3 percent to cover inflation). She then acknowledges the added pressure of Middlebury’s duty to its students, faculty and staff, as well as its desire to be “a perpetual institution.” Handy concludes, “our number one priority is to support all of our clients to work together to make the world a better place.”

7:58 - Handy states that Middlebury has about $6 million invested in explicitly sustainable companies, and another $20 million in a manager that uses ESG criteria.

7:58 - “Divestment would require a buy-in by all of our group.”

7:57 - Handy explains that Investure strives “to provide a service level comparable to that of any individually-managed investment office.” She tells the audience that “we [Investure], like everyone here, want to leave the world a better place, and believe that we can provide our clients with the resources to continue their missions.”

7:55 - Handy will speak next, discussing why Investure relies on commingled funds to meet clients’ needs, what constraints govern the management of Middlebury’s endowments, and Environment, Social and Governance (ESG) criteria that Investure employs.

7:54 - Norton adds that his financial role is to provide for the education opportunity of both current and future Middlebury students. He concludes by asking the trustees to consider the implications of divesting from fossil fuels, as the energy companies occupy a “large portion of the investment space.”

7:51 - Norton continues in explaining that since 2005, Middlebury has contracted with Investure to manage the College’s portfolio. He states that the College decided to contract with Investure for the promise of “access to investment opportunity comparable to large endowments.”

7:50 - Norton explains that the role of the College endowment is two-fold: 1) It is used to support the education of current Middlebury students, which was $50 million for FY 2013. 2) It is used to support the education of future Middlebury students. This is done by creating future generational equity, which aims to maximize returns, with a return objective of at least 5% plus inflation to ensure preservation if not positive gain.

7:47 - Salem begins the panel by asking Norton four questions: “Why does the Colelge have an endowment? Who decides how much is spent and on what basis? Why does the College delegate to Investure? What are the key elements of Investure’s mandate to the College?”

7:45 - Salem announces that the forum will last for approximately 100 minutes. The first half will be a series of questions posed by the moderator to each panelist in turn. Each panelist will answer in approximately 5-7 minutes. The panelists are then encouraged to “cross-examine” each other.

7:44 - Salem acknowledges that the “tools of my trade [are] tedious at best and maddening at worst — including many of us that manage money for a living.” He urges the audience to “base your views on primary sources, search aggressively and endlessly for facts contrary to your evolving thesis and defend at all costs ‘the illimitable freedom of the human mind.’”

7:41 - Salem takes the podium and thanks Liebowitz, the panelists and the audience. He jokes that the recording of the forum should contain the warning, “viewer discretion advised.” Salem requests that the panelists and the audience “leave for another day the scientific challenges that lie at the heart of the global debate about climate change … to important to be taken up — yet alone resolved — by tonight’s panel.”

7:38 - Liebowitz discusses decorum, and asks that “no one does anything to interfere with anyone’s ability to see or hear this discussion.” He then welcomes the moderator, David Salem ’78.

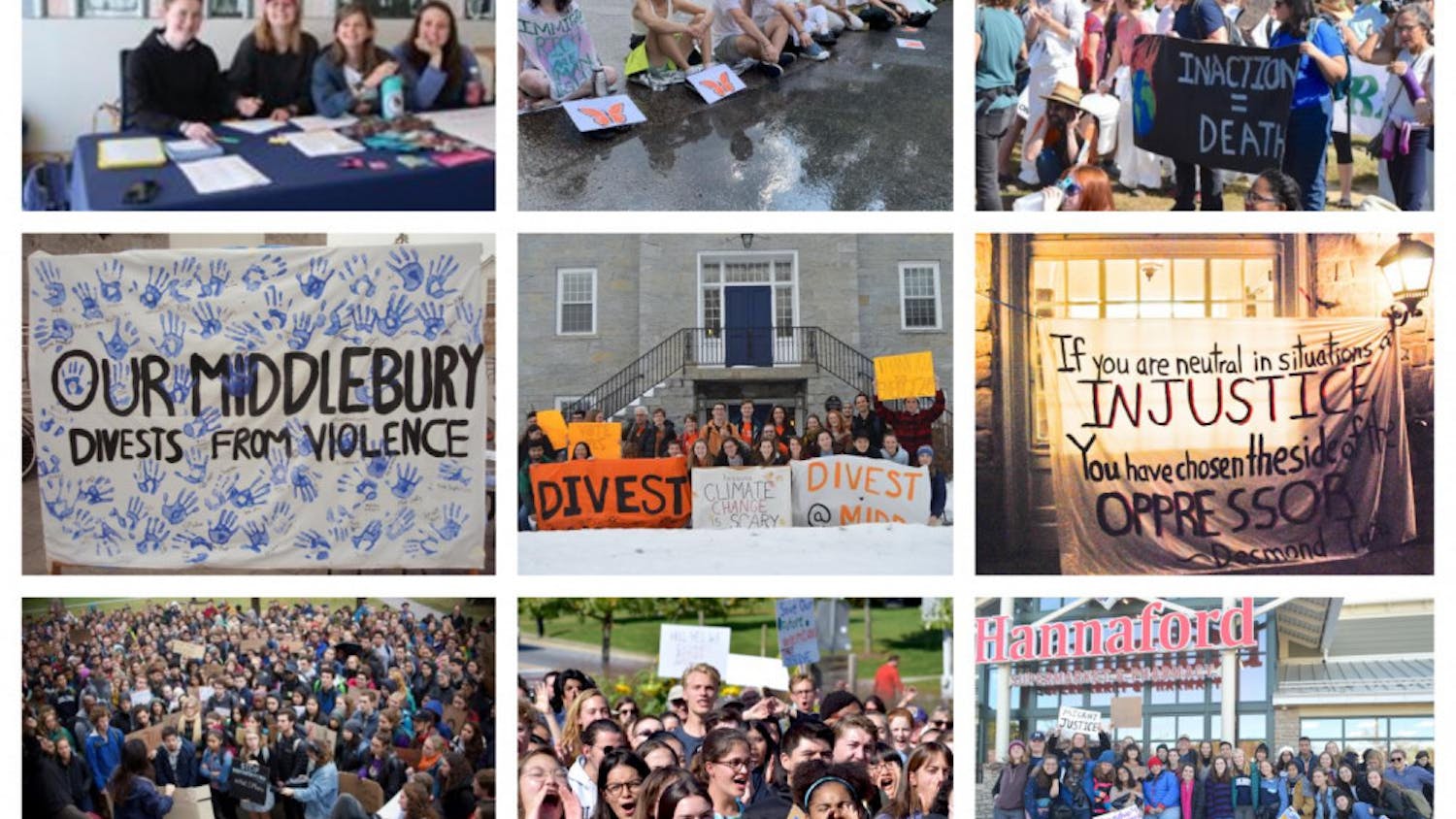

7:36 - Liebowitz welcomes and thanks the audience for attending. He explains that this is the first of a series of discussions about divestment, an issue of “great interest and importance,” and he expresses his pleasure that “the College is taking a leadership role.” Liebowtiz cites other examples of student involvement in the creation of institutional policy, such as the establishment of study abroad sites and the retention of winter term. He mentions that “several student groups raised questions regarding Middlebury’s endowment” throughout the fall.

7:33 - McCullough has continued to fill, but there are still many open seats throughout the auditorium. All panelists are on stage, conversing. Various seats throughout the auditorium are reserved for displaced peoples, a silent protest of sorts. The crowd quiets as the panelists sit down and President of the College Ronald D. Liebowitz takes the podium.

7:18 - McCullough Social Space is slowly filling up. Ushers are checking IDs at the door if you're planning on coming. Some individuals are wearing "DIVEST MIDD" shirts. Upon entering, many attendees were given a pamphlet entitled "The Middlebury Divestment Reader," compiled by 350.org.

[A Note About Liveblogs: Although we do our best to accurately present events and quotes, the instant nature of liveblogging sometimes leads to errors in our reporting. If you feel like you have been misrepresented or misquoted in our coverage above, please do not hesitate to contact the Campus.]