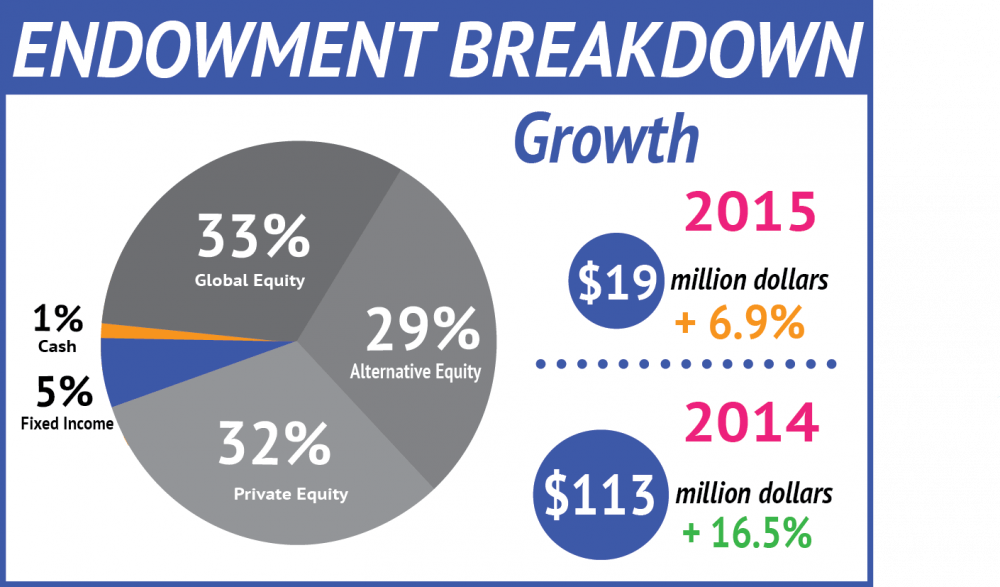

The College’s endowment yielded a 6.9 percent return on investment during the fiscal year that ended June 30, 2015, beating national averages. Despite the $19.1 million increase, the endowment grew less than last year’s 16.5 percent rate of return.

Vice President for Finance and Treasurer of the College, Patrick Norton, said the endowment performed better than the MCSI All Country World Index, a global equities benchmark, which increased only 1.2 percent in the same period.

“The 6.9 percent return was actually a strong annual return given the performance of the global markets,” said Norton. “Our active management has outperformed the passive benchmark by 180 basis points (bps) a year over ten years. That is substantial outperformance.”

The endowment increased by $19.1 million during the fiscal year, rising to $1.10 billion on June 30. Explaining this growth, Norton cited the net increase in endowment from investment return, new gifts to the endowment and annual endowment spending for Middlebury’s operating and capital expenditures. Last year, the endowment grew 16.5 percent and increased by $113 million.

The College uses a passive benchmark to see how a portfolio would have done if it only invested ‘passively’ in broad equity and fixed income. “If we had invested according to our passive index our fiscal year ’15 return would have been 1.9 percent rather than our actual 6.9 percent,” said Norton.

The benchmark assumes 75 percent is invested in the MSCI ACWI Index and 25 percent in the Bank of America Merrill Lynch US Treasury 7-10 Year Index.

Each year, the endowment funds faculty compensation, programming costs and financial aid, among other College expenses.

Norton said, “The budgeted endowment draw into operations for fiscal year 2016 of $60.1 million which will support 23 percent of the operating costs of Middlebury College, two percent of the operating costs of the Middlebury Institute, and 16 percent of the operating costs of the Middlebury Schools.”

He added the endowment is globally diversified across a number of asset classes: 33 percent global equity, 29 percent alternative equity, 32 percent private equity, five percent fixed income, [and] one percent cash.

When deciding how to manage the endowment, the administration has considered student initiatives such as the call for divestment from fossil fuels.

“The College has worked very closely with our investment office, Investure, and several other clients to invest a portion of our endowments with managers who utilize Environmental, Social and Governance criteria into their investment process,” said Norton. “We estimate that as of June 30, 14 percent of the endowment is invested with such managers.”

While students are taken seriously, the College cannot accommodate all such requests. In an August 2013 Statement on Divestment, then-President Ronald D. Liebowitz said most financial managers like Investure as it provides flexibility to maximize return on the investment. In 2013, the College’s five-year return was “second only to Columbia,” he wrote.

“Investure invests money in large funds run by independent managers, whom Investure selects based on the strategies and performances of those managers over time. It is unlikely that any of the 150 fund managers who today invest Middlebury’s endowment in their commingled funds would adopt a policy of fossil-free investing,” Liebowitz wrote.

He added, “This is the answer to the often-asked question of why Middlebury, or any institution with a large endowment, cannot easily divest an endowment of fossil-fuel stocks. In Middlebury’s case, Investure would have to reinvest more than half of its portfolio. And it would have to gain the agreement of the other 12 institutions it represents to do so.”

As for the current investment scheme, Norton said in a news release that the College “continues to be pleased with the performance of our endowment under Investure’s management. As always, we’re grateful for the critical support from Middlebury alumni, parents and friends. Thanks in part to their generosity, the endowment has continued to grow.”

Endowment Results Show Growth in Fiscal 2015 Year

Comments