On Tuesday, Dec. 5 President of the College Ronald D. Liebowitz sent the following email to students, faculty and staff with a subject heading, "On the College's Endowment":

This fall, several student groups on campus have raised questions surrounding the College’s endowment, specifically with regard to holdings related to fossil fuels. One group, the Advisory Committee on Socially Responsible Investing (ACSRI), has been meeting regularly with Patrick Norton, the College’s Vice President for Finance and Treasurer, and one of its members attends Investment Committee meetings of the Board of Trustees. Other groups, some part of a national movement on college campuses, have also engaged the College administration and community, hoping to learn more about the College’s endowment, how it is invested, and whether we should divest of our investments in fossil fuel companies.

As an academic institution, the College administration and the Board of Trustees are interested in engaging our students’ interest in the endowment. Such engagement, however, must be serious and be based in responsible inquiry and research. It must also be respectful and inclusive of all opinions. A look at divestment must include the consequences, both pro and con, of such a direction, including how likely it will be to achieve the hoped-for results and what the implications might be for the College, for faculty, staff, and individual students.

With input from several groups on campus, including ACSRI, we will set up and host panel discussions with experts in endowment management and divestment. It will include, for example, representatives from the firm that manages our endowment (Investure), veteran investment managers, and our own Scholar-in-Residence, Bill McKibben.

The management of Middlebury’s endowment is complex and has evolved over time. We are part of a consortium with other colleges and foundations whose pooled resources are invested in a number of “fund-of-funds” and therefore the College is very limited in either selecting or deleting any particular investment within its overall portfolio. Despite such limitations, the Investment Committee, the Administration, and Investure have been working with ACSRI to ensure that socially responsible investing is discussed and reviewed as a regular and ongoing part of the investment process. We have instructed Investure and the managers they engage to follow the environmental, social, and corporate governance (ESG) principles that align investors with broader objectives of one’s mission and society at-large.

At the same time, the primary fiduciary responsibility of our investment committee is to maximize its investment returns to support vital programs including financial aid and staff and faculty compensation, while managing risk. Currently, the endowment finances approximately 20 percent of the College’s annual operating cost —approximately $50 million this past year. It is vitally important to understand both the risks and rewards of one’s investment decisions as we are the stewards not only of the endowment for the current generation of Middlebury students, faculty, and staff, but for future generations as well.

At present, approximately 3.6 percent of the College’s $900 million endowment is directly invested in companies related to fossil fuels. For those interested in the amount directly invested in defense and arms manufacturing, the share of our endowment in those companies is less than 1 percent—approximately 0.6 percent. I have included an explanatory note at the end of this communication to provide information on the methodology used to determine these percentages. I encourage you to contact Patrick Norton if you have any questions about this methodology or about the College’s endowment.

As President Liebowitz indicated, the email ended with a note on the utilized methodology:

Investure Managed Funds

Data on investments in fossil fuel and arms for Investure-managed funds (the “Investure Funds’) were provided by Investure, LLC (“Investure”) to Middlebury College upon request and only covers the underlying long holdings of the Investure Funds in those circumstances when information was available as described below. This information is presented on a lagged-basis, and does not include any underlying holdings in a client’s legacy fund portfolio. Moreover, this information is not based on a comprehensive review but rather is based solely on available information on the underlying long positions of the Investure Funds of which Investure has actual knowledge from third-party managers and/or reporting on the exposure of those underlying positions.

As a result, underlying positions may be missing from this analysis that, if included, could be material to an understanding of the College’s portfolio’s underlying positions in fossil fuels and arms. In those cases where Investure had actual knowledge of underlying holdings from managers and/or reporting on an Investure Fund’s exposure, Investure utilized a combination of third-party classifications, at its discretion, including but not limited to certain Standard Industrial Codes and the Stockholm International Peace Research Institute, to help identify investments in fossil fuel and arms companies. This information is solely for informational purposes, is not complete, and does not contain material information about the Investure Funds and a client’s portfolio. This information should not be relied upon in any way in making an investment decision. Investure reserves the right to make changes in a client’s portfolio at any time and Investure is under no obligation to update the estimated information included herein. With the aforementioned in mind, of the Investure Funds approximately 3.75% is invested in fossil fuels and 0.8% is invested in arms.

Non-Investure Funds (“Legacy Funds”)

For its Legacy Funds the College used the exact methodology to determine percentages invested in fossil fuels and arms as is described above for the Investure Managed Funds. With the aforementioned in mind, of the Legacy Funds approximately 3.2% is invested in fossil fuels and 0.1% is invested in arms.

Students received a forwarded version of the original email after "the all students address fell off." In what one can only assume to be a quip about the Dalai Lama Welcoming Committee's (DLWC) hoax email, Liebowitz continued, "I guess I needed to get permission."

Media outlets quickly picked up the story, with Seven Days posting:

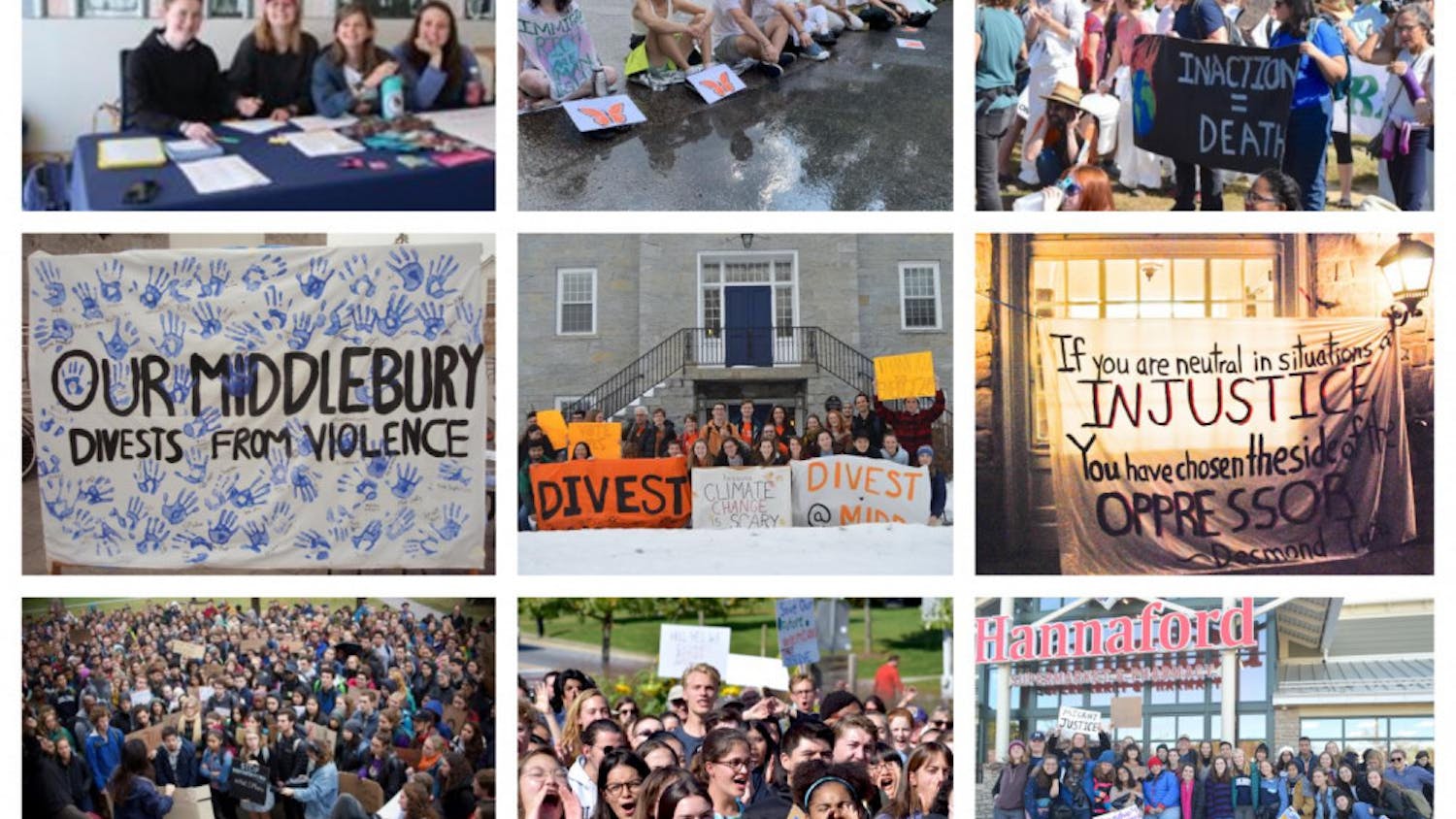

While the announcement isn't, by any means, a firm commitment to divest, the email sparked encouragement among students on campus campaigning for divestment. The divestment movement is spreading to college campuses across the country as climate activist and Vermont resident Bill McKibben headlines a bus tour to encourage schools, churches and foundations to strip their endowment funds of investments in the 200 top fossil fuel companies. McKibben told Seven Days last month that while divestment won't financially cripple the powerful industry, it could represent an "inherently moral call, saying if it’s wrong to wreck the climate, it’s wrong to profit from that wreckage."

McKibben, who also serves as a scholar-in-residence at Middlebury College, responded to Liebowitz's email on Tuesday with a statement through his environmental group 350.org. "President Liebowitz used just the right tone and took precisely the right step," McKibben's statement read. "It won't be easy to divest, but I have no doubt that Middlebury — home of the first environmental studies dept in the nation — will do the right thing in the right way. It makes me proud to be a Panther."

The article continued with student reactions:

It's a step in the right direction, says Greta Neubauer, a junior history major at the college from Wisconsin. Neubauer is part of a new campus group called "Divest For Our Future" that has been pushing for divestment this fall. The group is asking the board of trustees to release a statement that they recognize divestment as a priority, and are working toward that goal.

"We think that this is really an unprecedented opportunity for Middlebury to lead in this movement," says Neubauer, citing the college's early creation of an environmental studies program and its pledge for carbon neutrality as previous examples of leadership. "We really hope that they continue in that leadership role, and recognize that this is a chance to do something exciting ... and be seen as a leader in a movement that could potentially create real change."

Sophomore Teddy Smyth of Georgia, an environmental studies major, applauded the college for unveiling some concrete endowment numbers. While he and Neubauer both admitted that actual divestment would likely be a slow process, he says the fact that the administration is talking about this "is a huge first step."

VT Digger featured another quote by Neubauer '14.5:

“We are excited to see the college commit to continuing the conversation about divestment begun this fall,” said Greta Neubauer, one of the organizers of Divest for Our Future, a student group on campus. “We are also appreciative of the work they have done to provide greater transparency and believe that this is a positive step. “We look forward to continuing this community-wide dialogue and working to make fossil fuel divestment a reality at Middlebury.”

The Montpelier-based online publication also discussed the larger impact of President Liebowitz's statement:

The Middlebury announcement could have ramifications beyond the college because the college’s endowment is managed by Investure, a firm that also helps manage the endowments of a number of other colleges, including Trinity College, Smith College, Barnard College, and major foundations, such as the Rockefeller Brothers Fund and the Carnegie Endowment. Students at Middlebury have already connected with students at other Investure managed schools to discuss how to work together to push the firm in a more sustainable direction.

“Every college in the country should be, at least as transparent as Middlebury about how much money they have wrapped up in the fossil fuel industry,” said Dan Apfel, Executive Director of the Responsible Endowments Coalition. “Students deserve to know how much of their education is being paid for by companies that are wrecking the planet.”

The announcement will also help build momentum for other fossil fuel divestment campaigns across the state of Vermont. This November, students at the University of Vermont asked their board of trustees to divest its $346 million endowment from the oil industry. The Vermont Public Interest Research group is currently analyzing what percentage of Vermont’s pension fund is invested in fossil fuel companies. Two state legislators, Rep. Kesha Ram (D-Burlington) and state Sen.-elect Chris Bray (D-Addison) — who both serve on the UVM board of trustees — are currently discussing divestment policies with the State Treasurer’s office.

The Burlington Free Press and Middblog commented on the announcement. On Wednesday, Middblog continued their coverage through interviewing Student Liaison to the Investment Committee of the Board of Trustees Ben Chute '13.5 and Nathan Arnosti '13 of ACSRI. Chute and Arnosti provided some explanation for the more complicated aspects of the announcement:

MiddBlog: 3% of our endowment invested in fossil fuels, and less than 1% in weapons industries doesn’t sound like a lot to me. Is it less than you guys expected too? On the other hand, does that mean it will be more feasible to divest such a small part of our endowment? Or is it actually not that small?

Arnosti: I was also pleased to see that, according to Investure’s estimates, only 3.6% of Middlebury’s endowment is directly invested in fossil fuels, and .6% is directly invested in defense and arms manufacturing. These figures, certainly at the low end of SRI’s estimates, suggest that Middlebury’s endowment is not solely reliant on the fossil fuel industry for financial returns. Though our investments are spread across many vehicles – thus complicating the picture significantly – divestment from fossil fuels is more feasible when it comprises 3.6% of our portfolio than it would be with a larger percentage of these investments. That said, 3.6% is not trivial: with a $900 million endowment, that equates to around $32 million of investments in fossil fuels.

MiddBlog: Can you translate all the jargon at the end of his email into plain English? Where exactly do these statistics come from and what do they reflect? Are they showing the whole picture in your opinion?

Arnosti: To clarify the specifics of Investure’s reporting, Investure states that they have used “available information” from their many investments, meaning that these figures are approximated. It would be helpful to know what percentage of Investure’s investments were included in this approximation, as that would better indicate the potential margin of error. Also, it is important to note that these figures refer only to direct investments in fossil fuels and defense manufacturing. Thus, while Exxon Mobile might count as part of the 3.6%, a company that manufactures machinery for offshore oil rigs might not. Where we, as a community, draw the line with these industries is a crucial topic of discussion.

The New York Times also published an article about both divestment and McKibben, but made no mention of Middlebury or President Liebowitz's announcement.

Advocacy groups and activists similarly discussed the announcement. "Go Fossil Free," a project coordinated by a coalition of groups including 350.0rg, Energy Action Coalition, Responsible Endowments Coalition, the Sierra Student Coalition and As You Sow, reblogged VT Digger's summary. In the meantime, the DLWC also released a statement on their blog:

Liebowitz confirmed that Middlebury currently has at least $6 million and $32 million invested in industries of violence and environmental degradation respectively. Members of the College are working to reduce those numbers to zero, which would put Middlebury at the front of the pack in the growing national student movement calling for ethically invested endowments.

“One dollar invested in death, is one dollar too many,” says Tim Schornak of the Dalai Lama Welcoming Committee (DLWC), an organization of Middlebury students, faculty, parents and alumni working to align Middlebury’s endowment practices with its professed values.

Last October, the DLWC made national headlines for releasing a satirical press release claiming the College had chosen to divest from war in honor of the Dalai Lama’s visit to campus. Their action led the Middlebury College community to embrace the idea that investing in violence and environmental destruction is no joke. Alumni are weighing in with their agreement, pledging not to give a dollar more to the College until it does not go to war. Liebowitz’s remarks indicate that such a day may not be so far off.