The college is offering a new health insurance plan option to employees that will take effect on January 1, 2020.

Employees had the chance to either enroll in this new option or stick with their old insurance plans during a two-week insurance enrollment period earlier this month. A total of 113 Middlebury and Monterey employees enrolled in the new plan.

The new plan — called the Panther Plan — is a high deductible health plan (HDHP), which means the plan costs less per month but has higher deductibles and out-of-pocket maximums. It also includes a health savings account (HSA), an untaxed pool of money to which the enrollee and school contribute that can be used to cover eligible health expenses. This sets it apart from the existing option, which the informational materials distributed to employees refer to as a preferred provider organization (PPO) plan. The PPO plan has a lower deductible and a higher monthly premium and does not include a health savings account.

Lower upfront costs, higher deductibles

The Panther Plan offers enrollees an in-network deductible of $2,000, nearly seven times the equivalent deductible for the PPO plan. A deductible is a set amount of money an enrollee must spend on their health expenses before their health insurance starts covering a percentage of those expenses. This means that individuals enrolled in the new plan would have to pay for up to $2,000 of their non-preventative medical care before the insurance plan would cover a portion of the remaining expenses.

For in-network preventative care like immunizations, on the other hand, insurers pay the entirety of costs regardless of the deductible because of a federal regulation under the Affordable Care Act. This provision did not change from the old plan to the new one.

The new plan also has much higher out-of-pocket maximums than the old plan. An out-of-pocket maximum is the total amount enrollees can cumulatively spend on all their health expenses within the year before insurers pay for 100% of the remaining covered expenses. The higher out-of-pocket maximums for the Panther Plan mean that enrollees will need to pay more of their medical expenses in a given year before the maximums kick in and they are insured for the rest of the year.

Cheryl Mullins, the college’s director of human resources, explained that the school added the Panther Plan in an effort to provide interested employees with more health insurance options.

“From the employer’s perspective, such plans are a little less expensive and tend to have lower increases over time,” she said. “We think the plan is a win-win for the college and certain employee demographics.”

The college also introduced the new Panther Plan in part because of the potential benefits of a health savings account.

“HDHPs with HSAs are really attractive to various employee subsets, in particular because of the triple tax savings available under the HSA,” Mullins said.

The school intends to contribute $1,000 to individual and $2,000 to family HSAs under the Panther Plan. For this past November enrollment cycle only, the school will incentivize employees to choose the new plan by contributing an additional $400 to individual HSAs and $600 to HSAs for employees covering themselves and one or more dependents. This sum, and any money enrolled employees choose to put into their accounts, is not taxed when it is deposited or withdrawn, and can be used to pay certain medical expenses tax-free.

“The new plan is certainly not for everyone, but for those individuals who are looking to maximize tax qualified savings it’s a great option,” Mullins said. “The plan is also great for employees who are relatively low utilizers of the health plan as they have the opportunity to amass a nice nest egg that can be used for medical expenses in the future, as needed.”

Overall cost remains a concern

However, other school employees expressed concern that the risks of a plan with a higher deductible might not be worth the lower premiums and potential tax benefits. Katie Gillespie, associate director for research compliance and member of the compensations and benefits committee of the staff council, decided to re-enroll in the school’s old PPO plan.

“I can see how the HDHP with HSA may provide cost savings for some, but it’s also kind of a gamble,” Gillespie said. “Of course we all hope to be healthy in the coming year, but if you end up having unforeseen medical expenses, you might end up paying more in the end.”

Gillespie also mentioned that a few people she had spoken to were worried the school might eventually take away the PPO plan option.

“While we don’t currently have an indication that will happen, changes in the name of cost savings can always put people a little on edge,” she said.

Randall Ganiban, a professor of classics, also opted to stick with the PPO plan. He explained that it appeared to him the new plan benefitted younger, single employees rather than families. He agreed with Gillespie that the PPO plan seemed worth the higher monthly premiums for many of the employees he spoke to.

“It seemed that most people I spoke to preferred the PPO plan,” Ganiban said. “Its coverage seemed to be broader and, even though the cost was a little bit higher, it seemed to offer more benefits in the long run.”

The school incentivized enrollment in the Panther Plan by making premiums, the charge for enrollment in a health insurance plan that participants incur every two weeks, more sensitive of employees’ different incomes. Panther Plan premiums, which are already lower than that of the PPO plan, will be based on a percent-of-income approach, while the PPO plan will continue using the tiered premium system the school has employed in the past. The tiered system places employees into groups based on $10,000 salary increments, and those in the same coverage category — for example, all those enrolled as families — have the same premium. This means that an employee making $20,000 and an employee making $29,000 pay the same premium, as long as they are both in the same coverage category.

As Mullins explained in a September email to her colleagues, this system is not always as sensitive as it needs to be.

“It does not respond automatically to pay variations — up or down,” she wrote. “And due to its tier basis, a small change in pay, from, say $39,000 to $40,000, will tip an employee into a new tier, which can result in a sizeable increase in employee contributions, rather than a small incremental change.”

The switch to a percent-of-income approach for the Panther Plan would therefore be a factor in deciding which plan to enroll in, as the new plan offers a mechanism for determining employee premium contribution more tailored to their specific income.

An employee’s decision to choose one plan or the other is also impacted by their tax bracket, given the potential tax benefits of the HSA, and the size of their household.

There are several other major differences between the two plans, including how they handle in- and out-of-network expenses, preventive and non-preventive care and copays.

For the PPO plan, the out-of-pocket maximums are the same for providers in- and out-of-network. However, the Panther Plan’s out-of-network maximums are double that of their in-network maximums, which would make seeing an out-of-network provider significantly more expensive. The two plans the school offers are through Cigna, a multinational health service corporation based in the U.S. and operating in more than 30 countries, according to the company’s website. In order to avoid the higher maximums for out-of-network care, Panther Plan enrollees would need to find health care providers exclusively within Cigna’s national network.

The old PPO plan pays for at least 80% of non-preventative costs both in- and out-of-network, and some types of covered care do not require that enrollees meet their deductible before insurance pays for them. The Panther Plan also pays for 80% of non-preventative in-network costs, but only 70% of both preventive and non-preventive out-of-network costs, and those enrolled must have met their deductible before receiving this coverage. Non-preventative medical procedures can include a large variety of care, with anything from allergy treatment and acupuncture to emergency care and organ transplants.

The old plan also has fixed copay amounts, with a $10 copay for generic brand drugs, $25 for preferred brand, and $40 for non-preferred brand. Panther Plan copays are a percentage of the cost of the drugs, with 10%, 30%, and 40% copays for generic, preferred brand and non-preferred brand respectively. This means that enrollees in the Panther Plan have to pay more in copays than enrollees in the PPO plan if the medication they are purchasing costs more than $100, but less if it is less than $100.

The Panther Plan provides school employees with lower premiums than the PPO plan and potential tax savings. During a healthy year, an enrollee might save on health insurance expenses and benefit from the health savings account, but during an unhealthy year, the higher deductible and out-of-pocket maximum could mean a greater financial burden.

“For some folks, myself included, paying a little extra in premiums is worth it for the peace of mind,” Gillespie said.

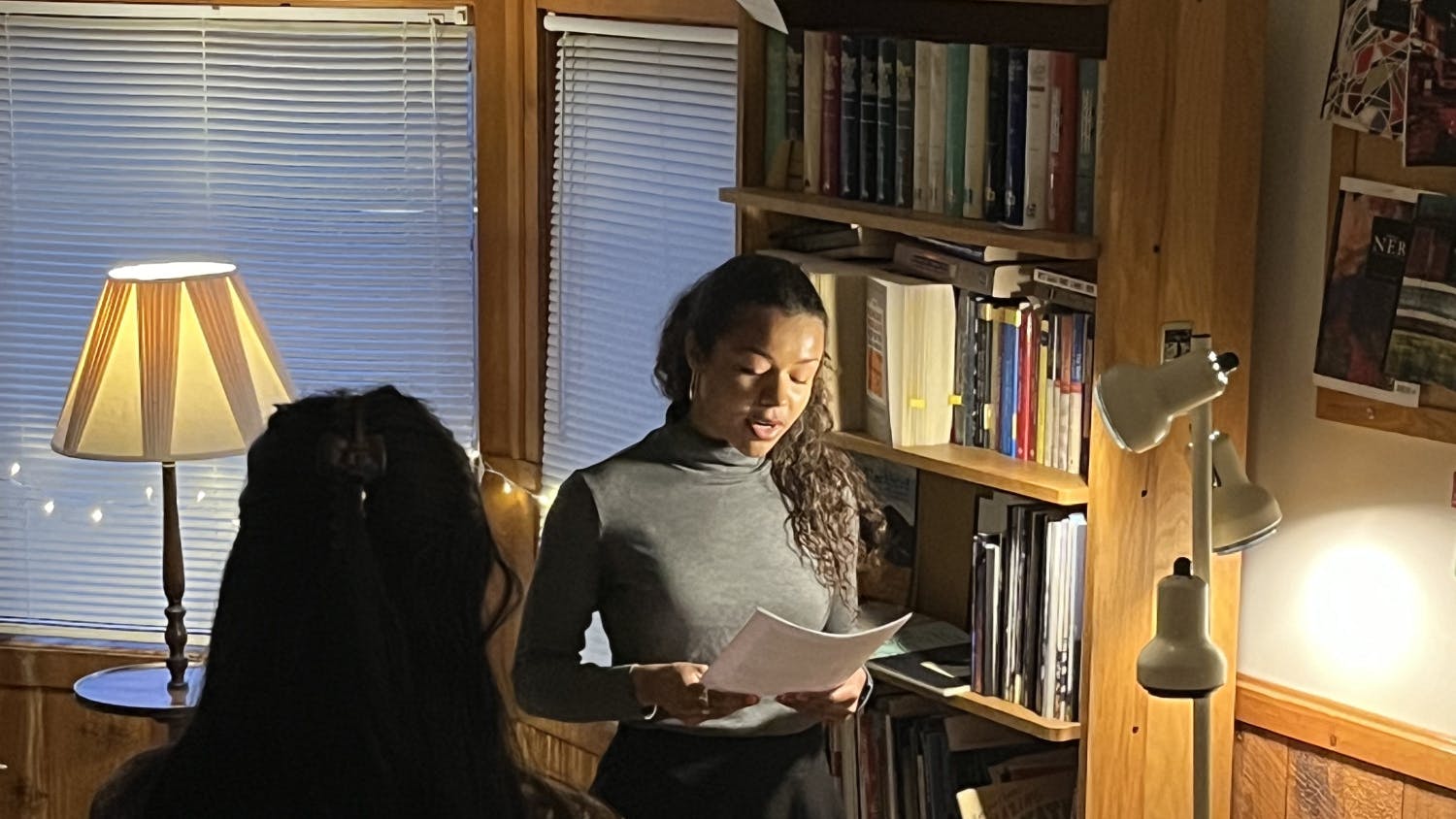

Abigail Chang ’23 (she/her) is the Editor in Chief.

She previously served as a managing editor, Senior News Editor, News Editor and co-host of The Campus' weekly news radio show.

Chang is majoring in English and minoring in linguistics. She is a member of the Media Portrayals of Minorities Project, a Middlebury lab that uses computer-assisted and human coding techniques to analyze bulk newspaper data.

Throughout last year, Chang worked on source diversity and content audits for different media properties as an intern for Impact Architects LLC. Chang spent summer 2021 in Vermont, working as a general assignment reporter for statewide digital newspaper VTDigger. Chang is also a member of the Middlebury Paradiddles, an a cappella group.