Vermont’s minimum wage will increase by 18 cents on Jan. 1, 2020, bringing the hourly wage to $10.96. The tipped wage, for state employees that receive the majority of their earnings through tips, will increase up $5.48, an increase of 9 cents.

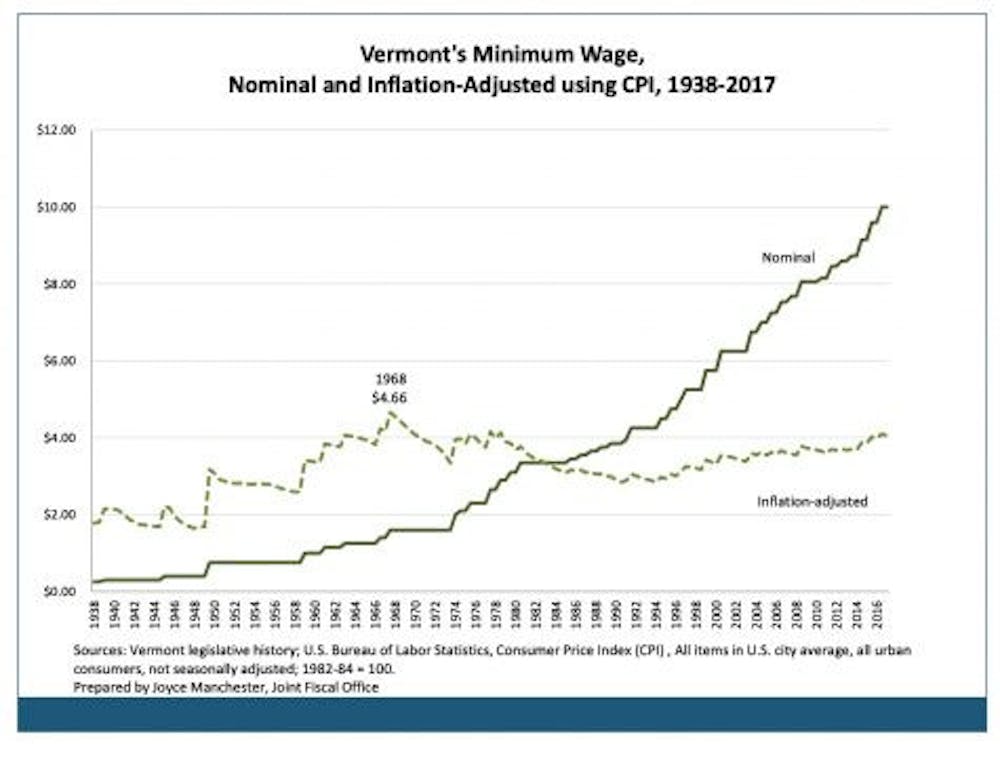

In 2014, the state passed Act 176, which raised Vermont’s 2017 minimum wage to $10. Under this law, minimum wage increases by the rate of inflation as long as the percentage increase falls below 5%, which has not occurred since 1990. The state determines the rate of inflation from the Consumer Price Index (CPI) and assures the change in minimum wage complies with the cost of living adjustment. Yet, the real wage value is still less than it was 50 years ago. Michael Harrington, acting commissioner of the Vermont Department of Labor, still believes the small pay boost will benefit workers.

“Any time we see natural growth in the minimum wage, as we do now, is good,” Harrington said. “I think employees will certainly find value in this increase, even though it is a small amount.”

Although the Vermont minimum wage has continuously increased over the last decade, the 2020 change is less than last year, when minimum wage rose by 28 cents. Furthermore, according to a study by the Vermont Legislative Joint Fiscal Office, Vermont’s single-person livable wage is $15 – $18, and the average living wage is $13.34. According to Peter Matthews, Middlebury professor of economics, minimum wage has yet to satisfy the standard cost of living.

“Even in the best-case scenario — a household with two full-time adult workers and no children – the current minimum wage falls well short of basic needs, as calculated by the Joint Fiscal Office of the Vermont legislature, and will continue to do so,” he said.

Tied with Arizona, Vermont’s minimum wage is the sixth highest in the United States and is significantly higher than New Hampshire’s federal minimum wage of $7.25. However, the minimum wage does not necessarily correlate to the state’s cost of living.

Vermont resident Emily Klar ’21 spoke to the disparity between income and living expenses. Two summers ago, Klar was an employee at Dunkin Donuts where she worked lots of overtime hours. She says she also held a second job for a while.

“Some weeks, I was working about 60–70 hours,” she said. “I was still barely able to save any money, and all I was paying for were gas and minor expenses. The expenses while working that kind of job were impossible to meet.”

According to Matthews, more than half of minimum wage workers in Vermont are full-time. “The sectors in which the current minimum wage is most salient include service — food, education and health — and retail,” he said.

In recent years, the Vermont House and Senate have considered several proposals to further increase minimum wage. House Bill 93/Senate Bill 40, the most supported bill thus far, would increase the minimum wage by $1 every Jan. 1 from 2018–2021, then by $1.5 in 2022 before maxing out at $15. If this bill was enacted, Vermont would tie with California for the highest minimum wage in the country. Advocates, such as state lawmakers and Vermonters, argue that a $15 wage would promote spending in local businesses and in turn boost the state economy. Opponents point to the higher cost for labor and the inevitable cutback of existing employees. In an article published by the Ethan Allen Institute, the authors write that a drastic increase in minimum wage would negatively affect underrepresented, underprivileged demographics, leading to structural unemployment in low skilled workers. In addition to the decrease in labor demand, businesses, unable to meet higher labor costs, would fail altogether.

When asked how the economy would respond to a $15 minimum wage, Professor Matthews emphasized the importance of national cohestivity. “Under ideal circumstances, the federal minimum wage would increase to $15 or more, and all states would be brought along,” Matthews said. He also said that an estimated 40 million workers would benefit from increased living standards. As stated in Vermont’s Joint Fiscal Office’s April report, “pronounced and growing minimum wage rate differential with New Hampshire and other states at or near the Federal minimum wage of $7.25 represents a potential economic risk.” The differential between Vermont and New Hampshire’s minimum wage is “the largest historical spread on record.”

Most recently, Governor Phill Scott vetoed a bill backed by Vermont Senate to raise minimum wage to $15 by 2024. Democratic leaders of the Vermont House and Senate have been unable to find common ground on legislation regarding this prospect.

Vermont’s minimum wage to increase

COURTESY PHOTO

Vermont’s minimum wage has increased rapidly over recent years using the consumer price index (CPI), according to data from the U.S. Bureau of Labor Statistics.

Vermont’s minimum wage has increased rapidly over recent years using the consumer price index (CPI), according to data from the U.S. Bureau of Labor Statistics.

Comments