On Monday, Sept. 30, Middlebury College released an update on its process of examining the endowment for investments in or connections to the war in Gaza. The college announced that it would not be taking any actions towards divestment from war profiteering, claiming it only maintains minimal investments in companies suggested for review.

Titled “Middlebury’s Exposure to AFSC’s List of Companies,” the announcement explained that per the request of Middlebury students earlier in 2024, the Board of Trustees audited the endowment’s investment portfolio against a list of 45 companies determined by the American Friends Services Committee (AFSC) to be profiteering from the ongoing war in Israel and Gaza. This list comprises both companies that manufacture products used directly in the war, including Lockheed Martin Corporation, Sturm, Ruger & Co. and Northrop Grumman Corporation, and companies that do not primarily manufacture arms or defense systems but contribute to arms manufacturing, like General Electric, Volvo and Rolls-Royce Holdings PLC.

As of Feb. 28, 2024, Middlebury’s exposure — the amount of money invested — to those companies totaled 1.10% of the total endowment through six different investments, according to the announcement.

Members of Middlebury Students for Justice in Palestine (SJP) met with various administrators and the Board of Trustees throughout the late spring and summer of this year while working on their divestment campaign. On May 10, SJP leaders presented their divestment campaign to the Resources Committee of the Board of Trustees. Next, they met on May 24 with Executive Vice President of Finance and Administration David Provost, Vice President of Student Affairs Smita Ruzicka, Board of Trustees Chair Ted Truscott and Vice Chair of the Investment Sub Committee Caroline McBride to initiate conversations about divestment.

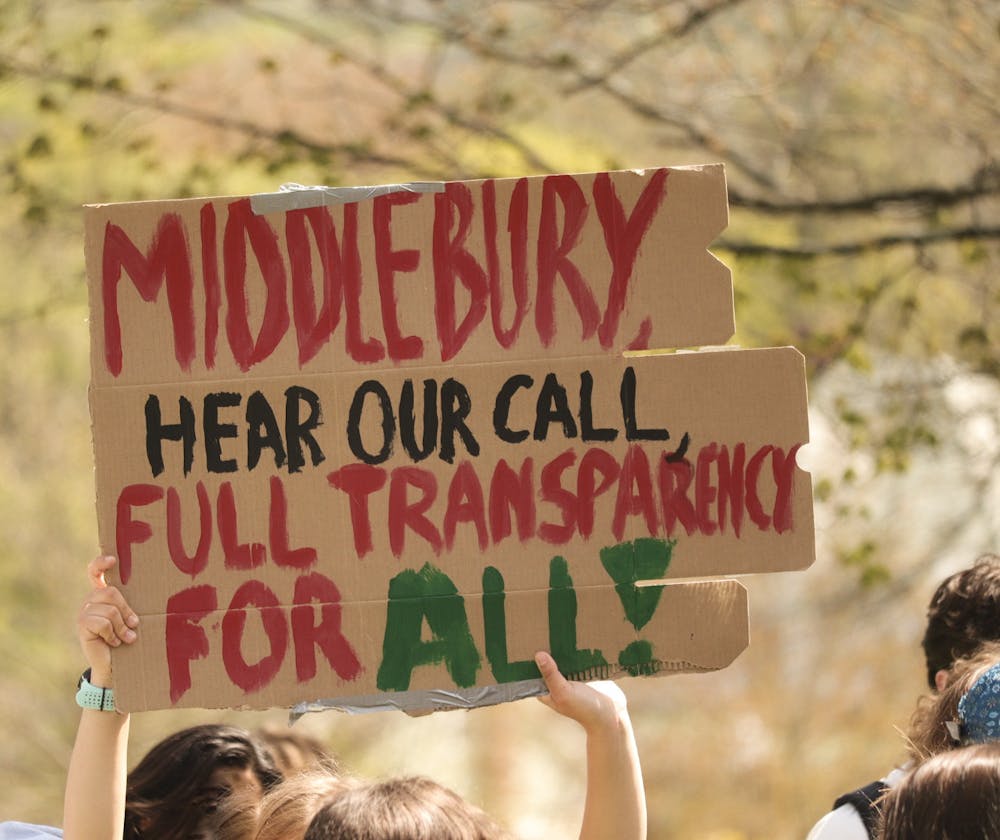

Also on May 10, the Student Government Association (SGA) released the results of a referendum in which students voted in favor or against four divestment objectives. The requests concerned financial transparency, removing investments from arms manufacturers and war profiteering firms, and ceasing financial support for Israeli businesses. Over 1800 students, or around 72% of those on campus during the spring semester, voted in the referendum, with large majorities supporting each of the four items, according to the SGA.

In June, SJP liaisons to the Board of Trustees presented the Investment Sub Committee of the Board of Trustees with a revised list of proposed companies from which to divest, which narrowed down the original 45 companies to 23 corporations.

The list was revised in the hopes of achieving progress on common ground towards their divestment objectives, according to SJP liaisons.

“As negotiations continued, we narrowed the list to demonstrate our willingness to come to a middle ground, while still emphasizing companies that are contributing to crimes and atrocities according to international law,” the four student liaisons wrote in an email to The Campus. On Oct. 23, 2024, members of SJP will present to the Resource Committee of the Board of Trustees and the College Board of Advisors.

The exposure of the endowment to those companies named on the AFSC list dropped to o.4% after being checked against the revised list, according to Provost. The biggest change, according to him, came from the removal of General Electric, which individually comprised roughly 0.6% of the 1.10% figure from the investment report from February 2024.

In August 2024, the Board of Trustees opted not to divest the narrowed 0.4% exposure, stating that the investments maintained in the target divestment companies were small enough such that the school was not profiteering from war, according to the announcement.

Middlebury, like financial peer institutions Wesleyan University and Brown University, relies on outsourced financial planning firms to manage the endowment portfolio. The college has contracted with Investure, a firm based in Charlottesville, Va. since 2005.

The objective of investing the endowment is to grow the portion of the endowment from which Middlebury can pull to fund annual operations, according to Provost. Each year, Middlebury releases five percent of its endowment — as of 2024, roughly $80 million — to fund operations for that year.

Provost explained in an interview with The Campus that Investure contracts with individual financial managers to select funds and companies into which to invest portions of the endowment. According to Provost, the college is in a pooled fund alongside 13 other institutions and organizations. This structure makes it impossible for Middlebury’s endowment to selectively withdraw from certain companies or funds without the consent of all 13 other fund members.

Provost explained that while the college maintains a close partnership with Investure, the Investment Sub Committee does not have any direct control over any single investment. In 2005, after establishing a contractual relationship with Investure, the Board of Trustees presented the firm with an investment policy, stating the school’s intention to minimize risk, maximize yearly returns and maintain ethical standards with regard to the investments made for the endowment. According to Provost, the Board of Trustees examines Investure’s performance and adherence to the investment policy every 10 years, and the college is currently in the midst of its second review of the partnership with Investure.

The urge for Middlebury’s divestment from companies manufacturing arms or profiting off of war builds on a successful student-led campaign to divest from fossil fuels, which began in 2011 and sparked the creation of the Energy2028 initiative. In 2019, the Board of Trustees approved a 15-year divestment plan, which will completely phase out fossil fuel investments from the endowment by 2034.

According to Provost, divesting from companies aiding or abetting the pursuit of armed conflict is a much less specific or clear process than divesting from fossil fuels.

“Fossil fuel is a very specific industry with very specific companies. This list that the student negotiators have given us is a broad range of companies and a broad range of industries. It includes car companies, it includes airline companies and it includes companies like ExxonMobil,” Provost said.

He argued that the students negotiating on behalf of the fossil fuels divestment movement framed their argument in terms of ensuring continued environmental support and impact for later activists. He asserted that, from the perspective of maximizing returns on an endowment, there is a distinction to be made between divestment objectives that operate on an abridged time scale — in this case, ending the college’s financial associations with arms manufacturers and companies implicated in war — and those that cannot possibly be resolved within a single lifetime.

“Those student protestors made a generational argument. ‘Look, your generation is handing our generation climate change. We are being educated, and we will become the leaders to address it, but help us today.’ This current charge is without that validity and credibility,” Provost said.

Though the Board of Trustees has declined to take coordinated action on divestment, SJP still maintained that their actions are oriented towards long term objectives and success.

“We understand that any divestment process will take years. That is why negotiations are only a piece of the puzzle to advocate against a more broad US complicity in genocide. Our working relationship with administration has allowed us to learn information about our institution that demonstrates our embedded role in the U.S. system,” SJP liaisons wrote. “Our goal is to continue negotiations, because at the end of the day we are in it for the long run.”

Cole Chaudhari ’26 (he/him) is a Managing Editor.

Cole is a managing editor at The Campus, where he has previously served as a news editor, copy editor, and staff writer. He is a junior, and is studying history and literature.