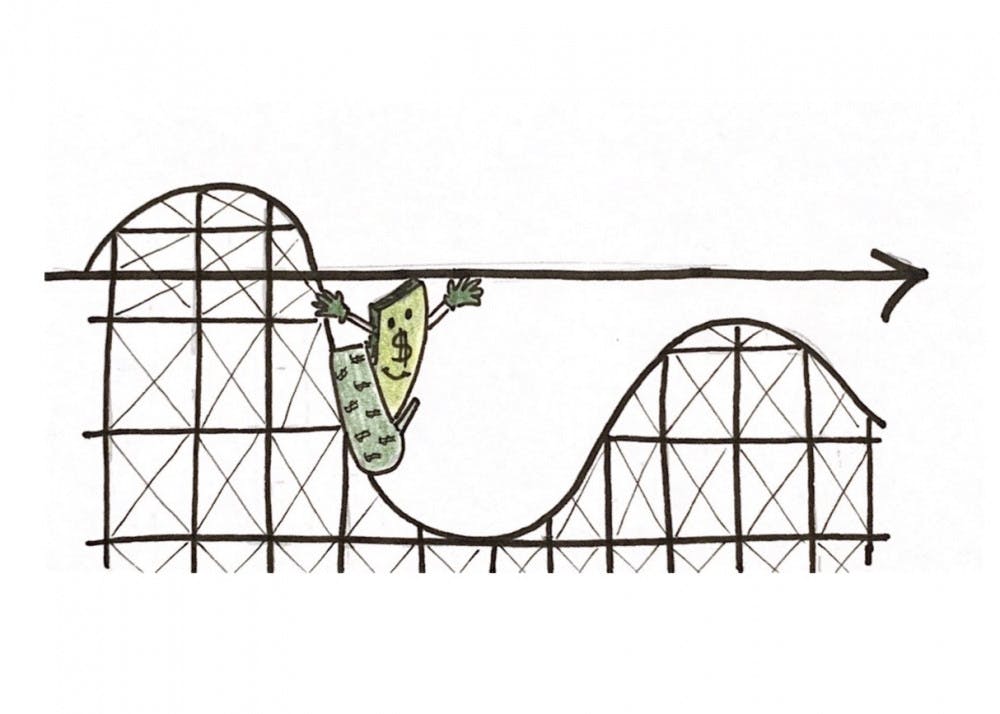

Before coronavirus hit, a lot of people thought 2020 was going to be their year. It was certainly going to be college treasurer David Provost’s. Following years of scrupulous financial planning and cost reducing, he had walked back the college’s once-astronomical deficit to a sustainable level. At the end of Fiscal Year 20, which stretches from July 1, 2019 to July 1, 2020, the college would only be $4 million away from its goal. By FY21, it would hit its target.

But the seismic shift of Covid-19 set those projections back. Middlebury’s budget deficit is now back to where it was in 2017, with a $13 million loss projected for this year. In the next fiscal year, which starts this summer, that figure could hit $30 million, provided classes stay online. To avoid drawing on the endowment, the college will cut as many costs as it can while also accruing as much revenue as possible.

Provost, however, remains optimistic that the college can lower its deficit by FY22. And he says that projections would have been much worse had the college still been operating under its earlier numbers.

“I think our ability to weather through 2020 is fully reflective of the work that the entire institution did the last four years,” Provost told The Campus.

The last five years

Middlebury has been trimming the fat on its operating costs for years. In 2015, the school faced a $16.7 million deficit, which Provost said totaled $33 million when accounting for overdraws on the endowment (a practice the college is now trying to avoid for the sake of the endowment’s health). Campus reporting chronicled rising financial aid costs and flawed tuition policies as some of the many reasons for the hefty deficit.

That year, it laid out a “Road to a Sustainable Future,” which included a plan to break even on the budget — and generate a small surplus — by 2021. Last year’s workforce planning process was one of its more conspicuous cost reduction efforts, cutting staff and faculty costs through an at-times controversial voluntary buyout program for staff and incentive plans for faculty.

Overall, the cost reduction efforts were successful, prompting the college in 2018 to accelerate projections for breaking even to this year. But this spring, the college announced that unexpected healthcare costs in 2019 created an approximately $4 million gap that still needed to be closed. Provost previously told The Campus that those healthcare costs could in part be due to the timing of workforce planning — people might have taken advantage of the college’s insurance plan to get medical procedures they have been putting off, for example, before taking the buyouts and separation plans.

Additionally, Provost said the deficit was partly due to the staggered nature of the workforce planning process, as some employees — including all the faculty at the Middlebury Institute of International Studies (MIIS) who took the incentive plans — still had to finish up the year before taking the buyouts.

Today

Those existing losses, in conjunction with the $9 million in losses for FY20 as a result of the coronavirus, contribute to an estimated $17.3 million in losses for this fiscal year. However, offset by cost-saving components like reduction in travel and food expenses, this deficit actually totals about $13.0 million for the year.

Those Covid-19-related losses come from four main areas: the $7.9 million in room and board refunds for the spring semester; the $900,000 in refunds for study abroad students; the $1 million in lost auxiliary operations from the bookstore, The Grille and other retail operations, the golf course, and the lost last month of the Snow Bowl’s season; and the $7.5 million predicted fundraising shortfall.

The Office of Advancement usually raises between $7–9 million in the last three months of the fiscal year. Now, with reunion canceled, it’s going to be difficult to do that. But the college gave families the option to donate their unused room and board credits as gifts; 19 families have taken them up on this thus far, for a total $83,000 in donations.

The college has also been preparing to embark on a capital campaign. The Office and Advancement and the Board of Trustees will reevaluate the timing of that campaign.

“Our donors and the largest donors in the world have lost a significant part of their wealth,” Provost said. “So that will play into thinking about that.”

The last capital campaign was also launched before a financial crisis, in 2007. It stretched from a five to an eight-year campaign, but ultimately surpassed the college’s target of $500 million.

There is also an estimated $800,000 in Covid-19-related expenses that the college will incur this year, which includes the over $110,000 it put toward helping students get home in March, which included travel expenses and gift cards for food costs.

Despite the recent buzz about the financial footprint of MIIS, Provost said he does not think Middlebury’s financial challenges stem from the institute. “They have been at times, but Monterey has done more to control costs and has been more successful at it,” Provost said. “They don’t have room and board so their FY20 numbers are looking pretty good. They might have a surplus.”

Looking ahead to FY21

In a recent memo to faculty and staff, Provost estimated the college deficit could swell to $30 million next year. That is assuming the college continues remote learning in the fall and then moves to in-person operations in the spring, and that there is full wage continuity throughout the year.

“If we are able to bring most students back, the lost revenue will be much smaller, and manageable,” he said, noting that they’re prioritizing trying to get as many students back to campus as possible.

So how is the college prepping for next year when everything is up in the air? Contingency budget plans. A lot of them. Provost is working on seven or eight possible plans, which he will present to the Board of Trustees for feedback next week at their May meetings. The college won’t make a decision on what it will do this fall — or which budget plan it will follow — until late June.

Each potential scenario will contemplate its individual impact on tuition, room and board. Provost said that under no circumstance will the college cease operations completely this fall. Doing so could bring the deficit to a whopping $90 million.

Losses from summer programming also factor into the FY21 budget. With some programs not happening at all and others set to be held remotely, Provost said he expects to see $4–5 million in revenue from summer programs, versus the usual $17.9 million the college usually receives from these programs.

Ameliorating losses

The college is now pinpointing how it might mitigate the FY20 and FY21 losses. Some reductions happen naturally: the lack of travel expenses, paired with the reduction in food expenses and other operating costs, will save the college $7.5 million or more. Investure — the firm that manages the college’s investments — has deferred its payments for their fees until June, which also helps.

Other efforts will require more active planning, which is where the Budget Advisory Committee comes in. That committee will make recommendations to the Board of Trustees about where to cut in the FY21 budget.

Each area of the college is currently reevaluating its spending. All departments may only use “essential” or “contractually obligated” expenses for the duration of the fiscal year. The SGA already pledged to redirect hundreds of thousands of its unused funds to staff wage continuity and student emergency support.

The college has also already instituted a hiring freeze, which will apply to all open faculty and staff positions for the foreseeable future. Likewise, the college will not allow departments to fill positions that open up in the coming months, with limited exceptions granted on a case-by-case basis by the Ways and Means Committee.

Typically, employees receive small percentage salary increases each year. The college does not anticipate it will offer those raises in the coming year. It is, however, still contemplating addressing the results of its compensation review — the study it conducted with an external consulting group to gather market data this year. The college is undertaking that review partly to address the increased turnover it has seen over the last two years in positions within the lowest pay bands. In January, it raised wages for staff in its lowest-paid positions as an effort to make itself a more competitive employer amid staff shortages and grievances about low staff pay.

“We may not be able to address the [compensation review] results in the first half of the year, but it remains a priority,” Provost said. Members of the Budget Advisory Committee say they have not gotten an update on the review and that it has not been part of their recent discussions.

If the college continues remotely in the fall, it will have to address a litany of other concerns. Provost has consistently said that wage continuity is a priority for the college, but to continue to pay everyone, it might have to consider reducing all employees’ pay. Already, President Laurie Patton and some members of the Senior Leadership Group have taken pay cuts, per the most recent memo. Provost said employees with lowest wages would be the least impacted by the pay cuts, if they were to happen.

The college will also receive about $1.8 million from the federal government, The Campus reported this week, as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Ultimately, Provost thinks the college can balance the budget by FY22. The effort to balance the budget from a similar deficit took years the last time around, but that was because the college was spending past its means and not taking in enough revenue. This time, revenue, not expenses, is the problem.

Assuming the college can maintain its desired levels of enrollment, Provost said things should even out within the next 12–18 months.

“So when we return to normal, the revenue should go back, too,” he said.

The endowment

Throughout all of this, Provost says he does not plan on drawing more from Middlebury’s endowment than he would have pre-Covid-19. In recent years, the college has been pulling roughly 5.1–5.2% from the endowment — the industry standard for non-profits — and FY20 will be no exception. That amounts to about $57,590,000 this year, taken out in four installments throughout the year.

Provost estimates those numbers will be about the same for FY21. The dollar value of that 5% will be determined by a period of time before December 2019, pre-coronavirus. Any decline related to Covid-19 in the markets, then, would not take effect until FY22.

As for the current state of the endowment, Provost said the numbers are not in the red zone. He said the college has stress-tested the endowment and estimated that if assets were down 30%, it would be in trouble. Currently, those assets are down about 10%.

The college is awaiting the first quarter results of the endowment for the three months ending on March 31. Those results will be presented to the Board of Trustees next week.

Editors Bochu Ding and Benjy Renton contributed reporting.

The college was about to finally break even on its budget. Then everyone got sent home.

Comments